Investor Relations

From an employee base of 90 personnel in 2007, ELSEWEDY Electric PSP’s numbers have grown significantly, to a current workforce of around 1500. Annual revenue has also proven an incredible upward trend, from around US$10 million in 2007, to around US$1.2 billion as of today.

Throughout the last 15 years, ELSEWEDY Electric PSP have been expanding within the MENA region through well-structured and planned growth strategy. Breaking all records that any establishing company could break. ELSEWEDY Electric PSP begun challenging with the top EPC contractors in Egypt and the region, aggressively. Thanks to our strong financial capabilities and these of our holding company, ELSEWEDY Electric , that we’ve been leveraging on and supported us with a competitive edge to allow project finance in Egypt and African countries.

Company Performance

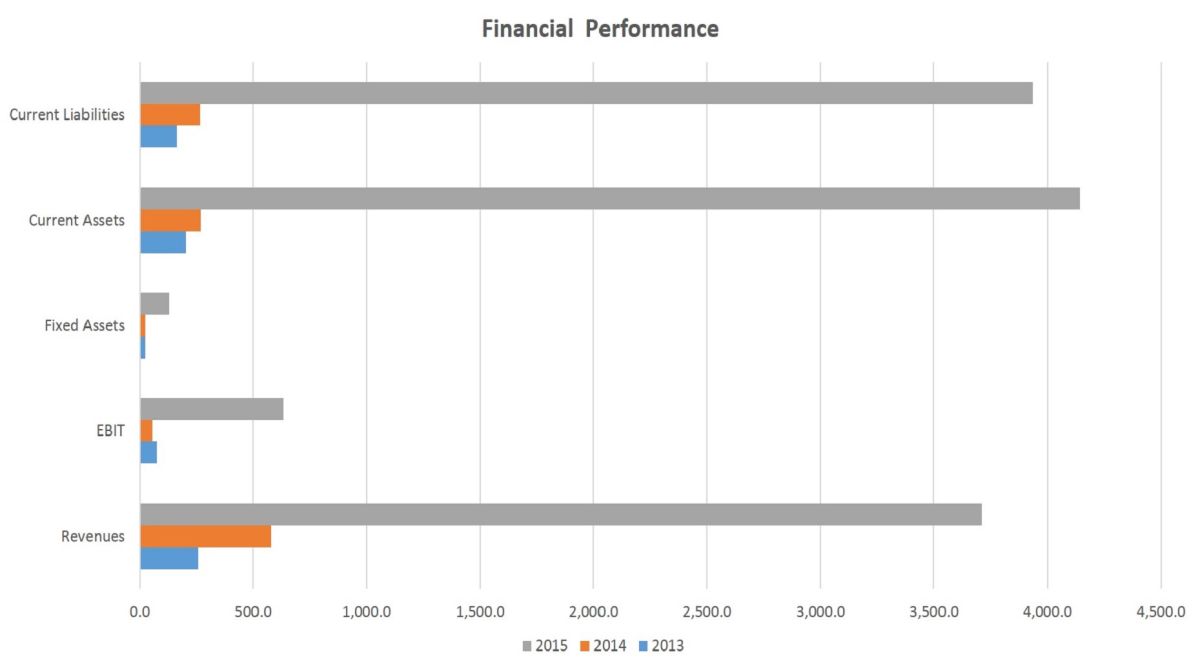

| Indicator | 31-December-2013 | 31-December-2014 | 31-December-2015 |

|---|---|---|---|

| Revenues | 257,836,006 EGP | 579,138,650 EGP | 3,711,229,849 EGP |

| Earnings before Interests and Taxes (EBIT) | 75,897,755 EGP | 55,883,036 EGP | 631,738,901 EGP |

| Fixed Assets | 23,822,875 EGP | 24,774,363 EGP | 128,687,471 EGP |

| Current Assets | 204,573,909 EGP | 269,439,385 EGP | 4,144,869,101 EGP |

| Equity | 67,118,686 EGP | 57,112,639 EGP | 335,974,273 EGP |

| Current Liabilities | 163,892,923 EGP | 265,538,696 EGP | 3,935,530,940 EGP |

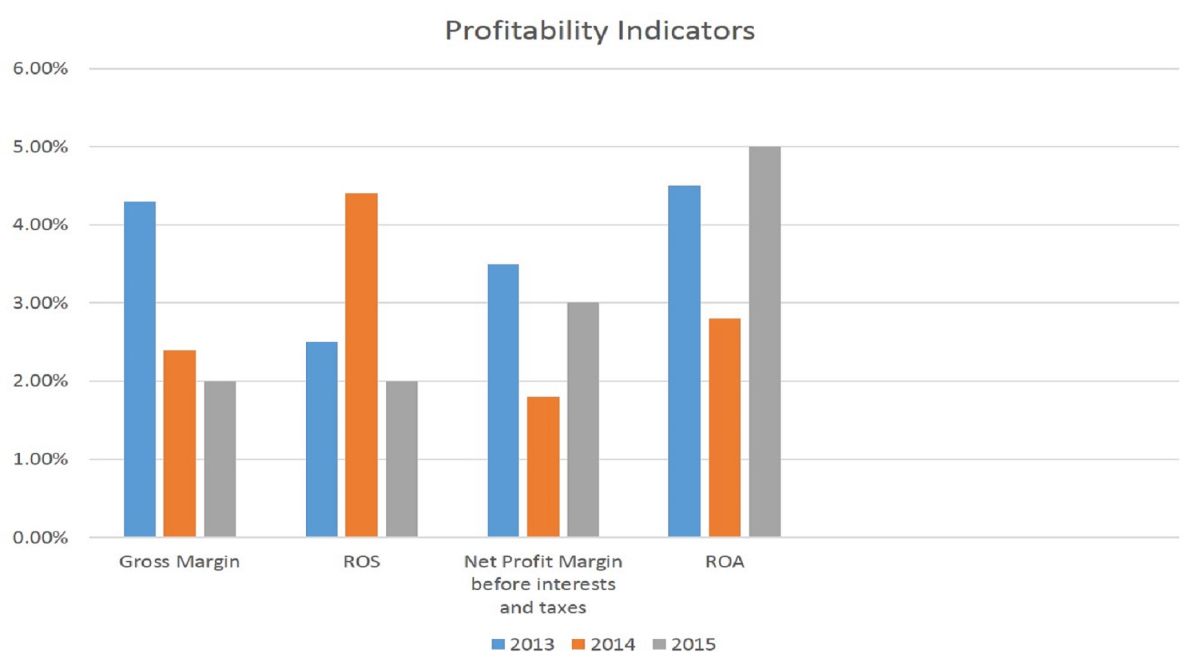

| Profitability Indicators | Year 2013 | Year 2014 | Year 2015 |

|---|---|---|---|

| Gross Margin | 36% | 13% | 17% |

| Return on Sales (ROS) Net Profit Margin before interests and taxes |

29% | 10% | 17% |

| Return on Assets(ROA) | 32% | 17% | 15% |

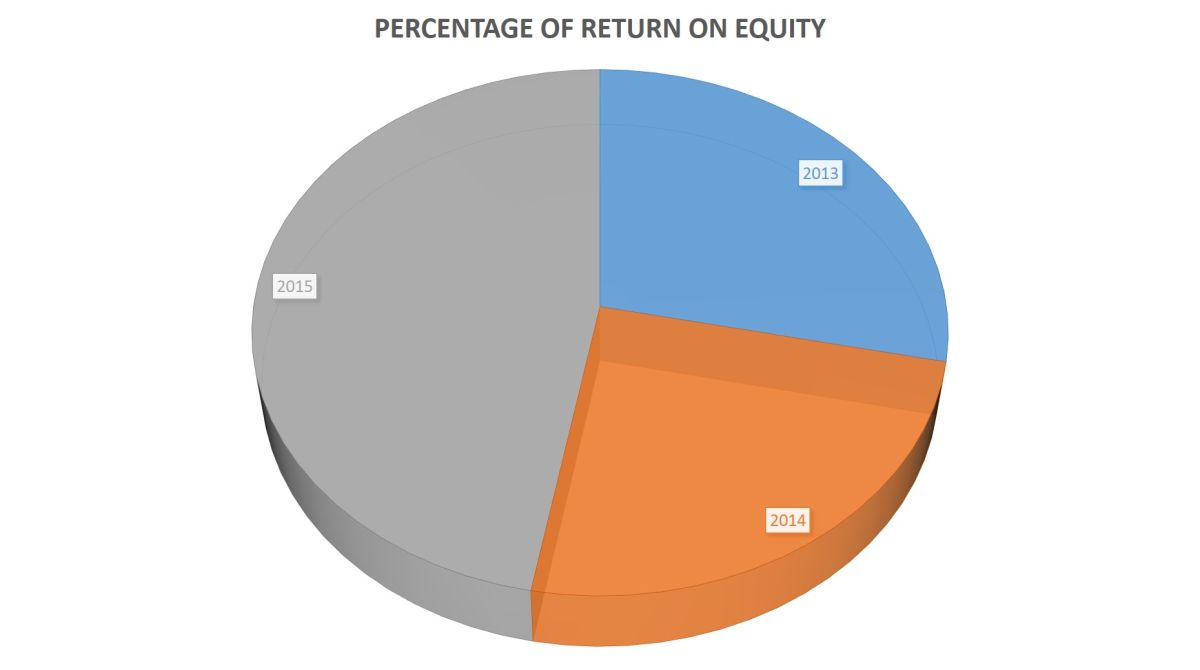

| Return on Equity(ROE) | 113% | 98% | 188% |

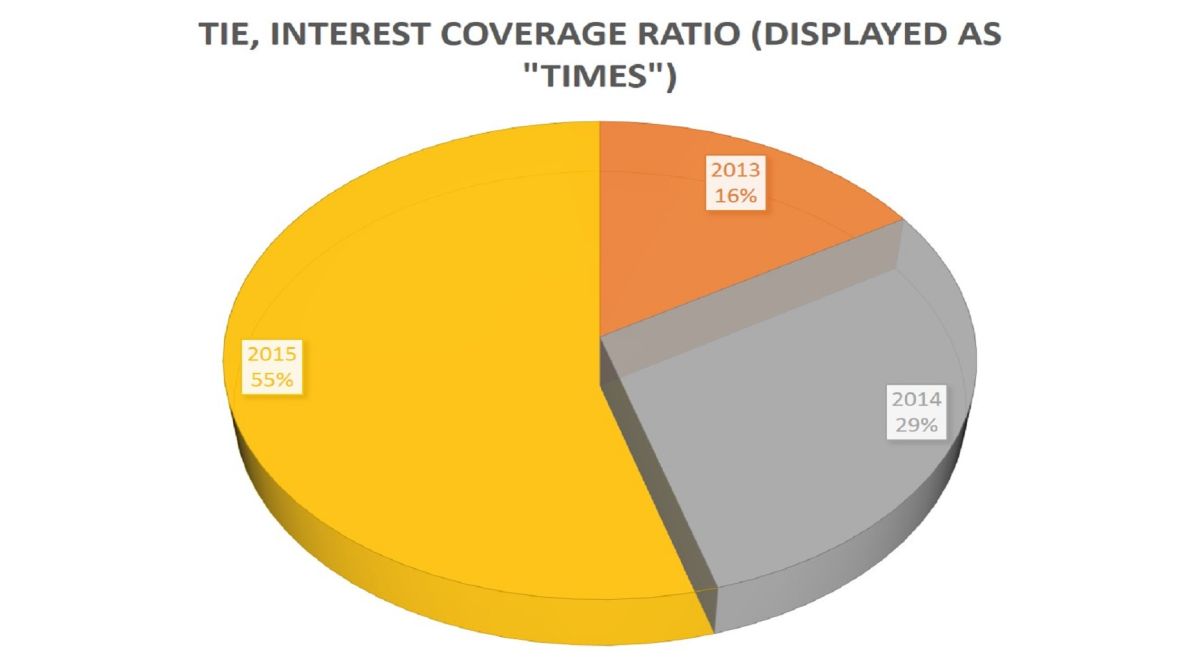

| Times Interest Earned (TIE) Interest Coverage Ratio (displayed as "Times") |

30 | 54 | 101 |